how to trade bull flag

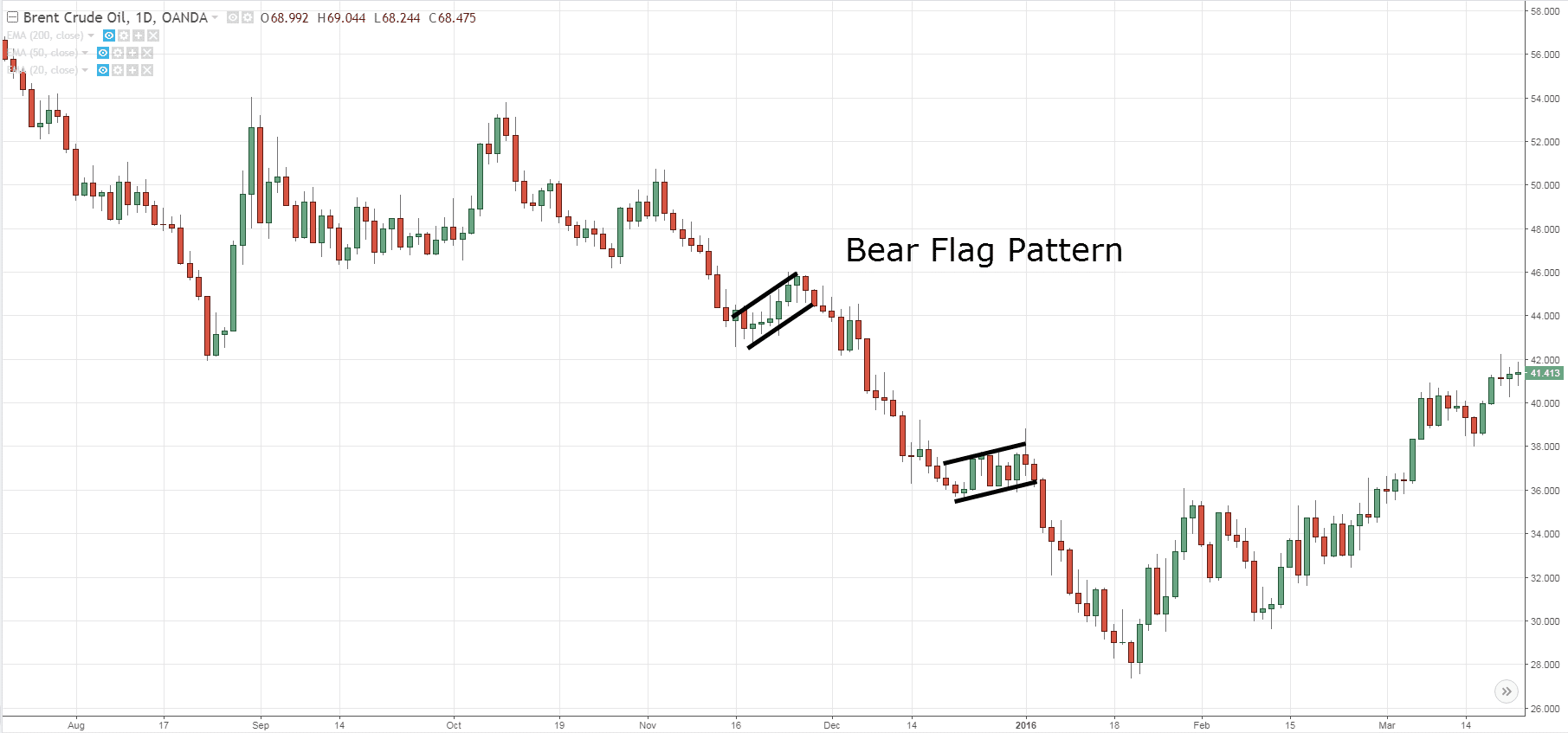

The pennant flag narrows to a point eventually breaking to the high side. The bear flag pattern on the.

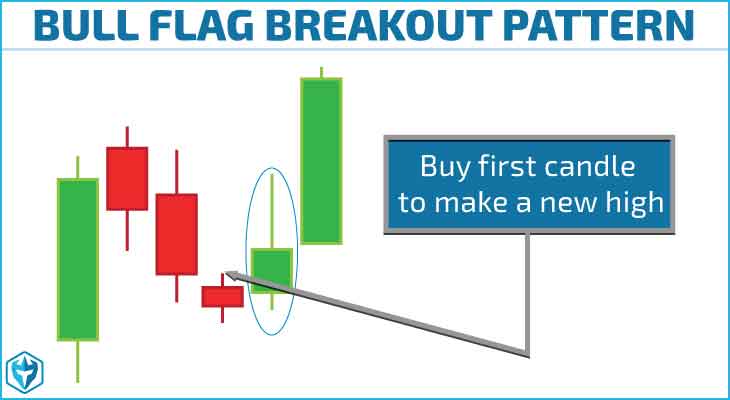

The Bull Flag Pattern Trading Strategy

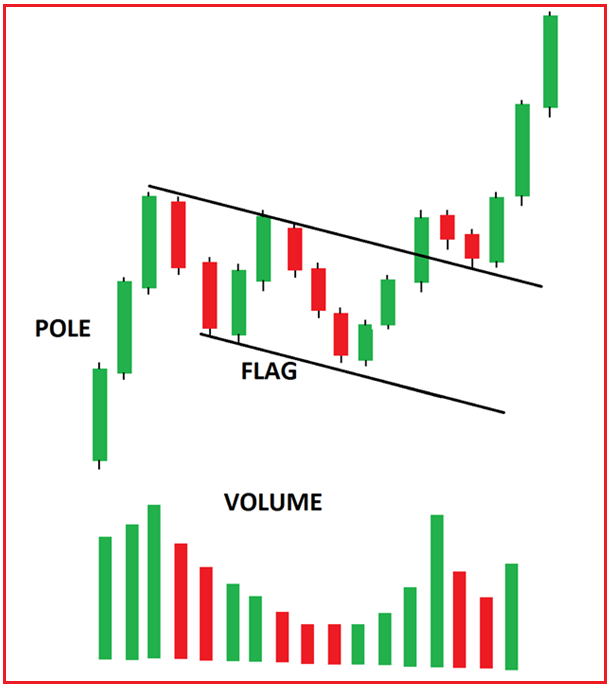

A bull flag pattern is one of the most reliable continuation patterns in trading.

. The bull flag pattern is one of the most sought-after chart patterns. Identify an evolving uptrend in an FX pair. This chart pattern helps traders choose the best entry and exit.

Stop-loss should be below the flag support in a bull flag breakout entry. When trading a bull flag traders might use. Take our free courses.

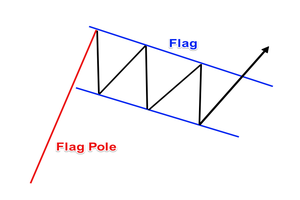

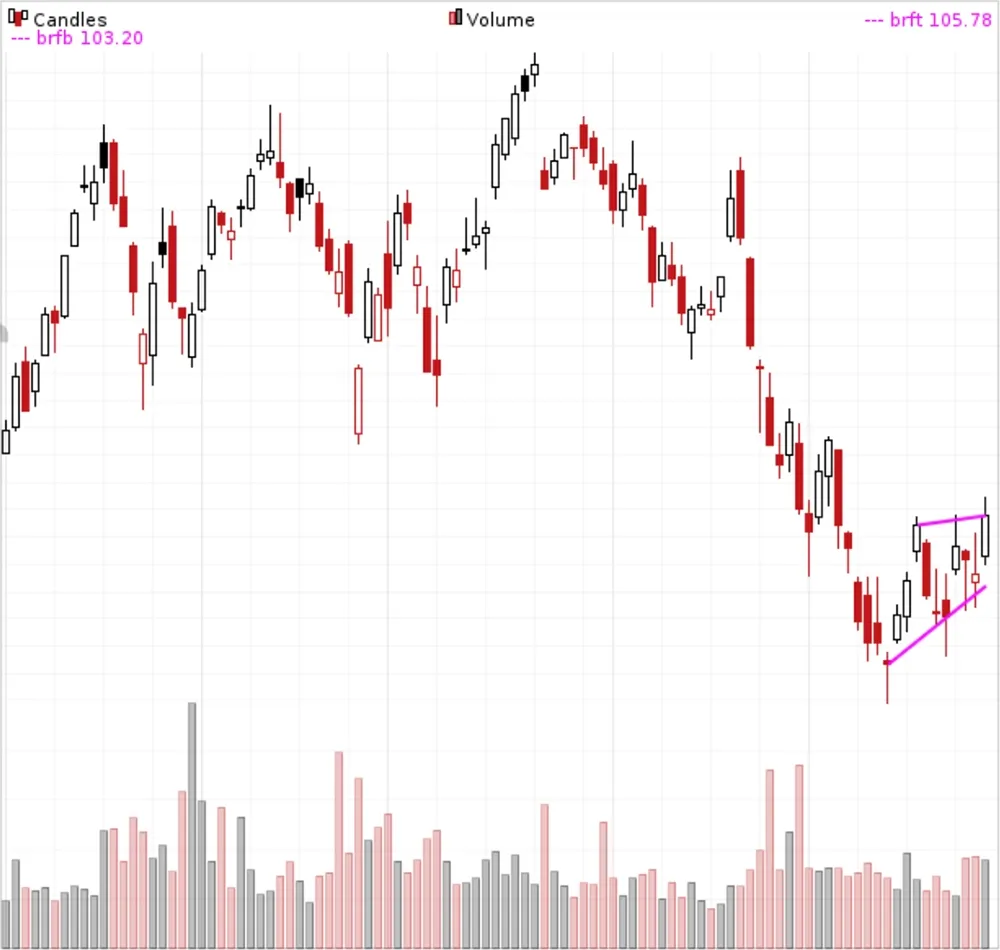

The height of the flagpole projected from the breakout level will arrive at a proportionate target. Want to Learn More Get info on My Strategy and Courses here. Other bulls flags will have parallel lines.

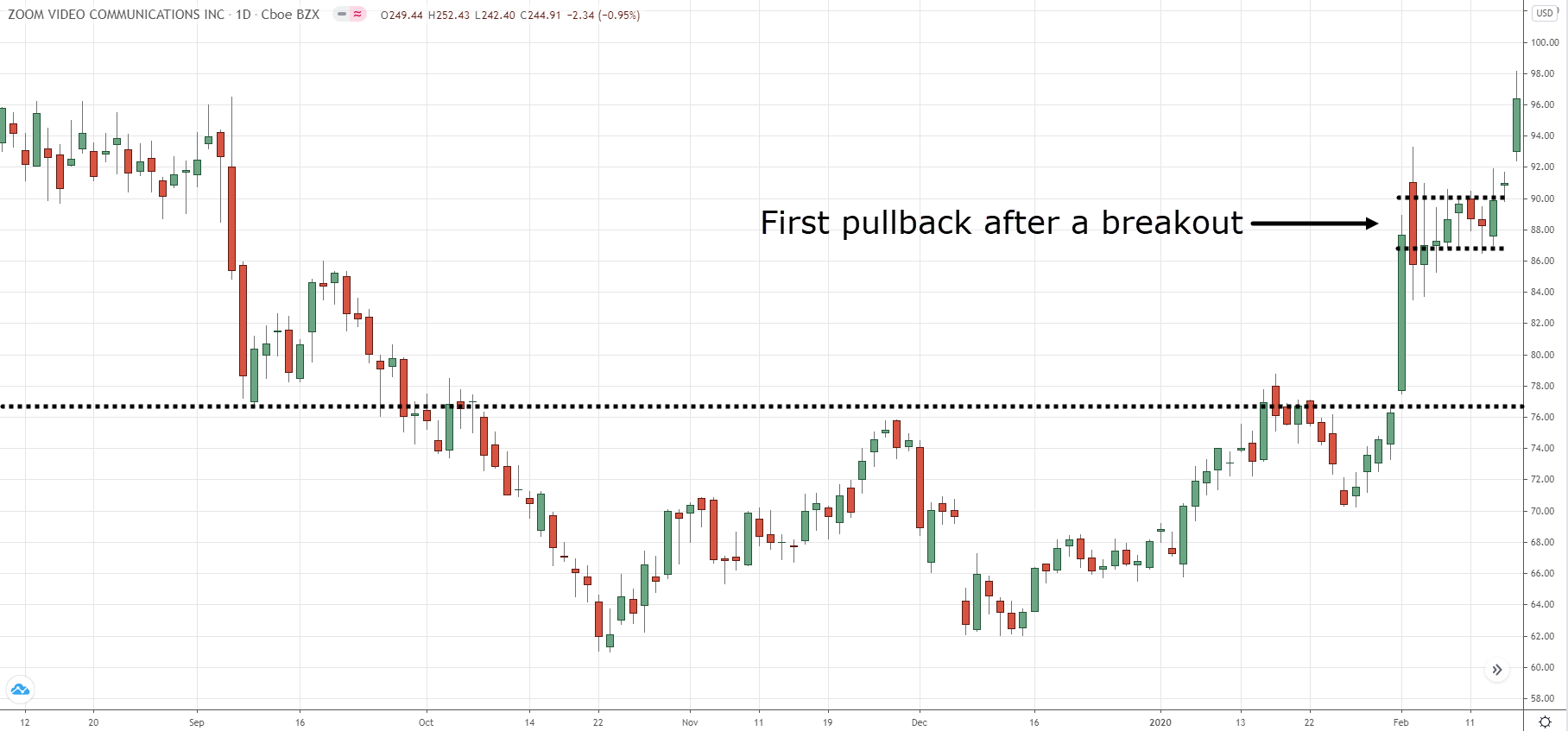

How to trade the bull flag pattern. In a bull flag pattern there needs to be a 90 price rise or more within a couple months before the horizontal consolidation. Trade the breakout of the flag in the direction of the pole.

In order to trade the bull flag pattern you need to take into consideration the context of the stock the trend the volume and the entry. Bull flags have been rare over the last few months of 2008 but they have been beginning to surface in conjunction with the recent market rally. The retracement should not be less than 38 and its not a bull flag even if it is.

Anything less than that and you have a less bullish flag pattern. This pause gives the market a. Entry and Stop Loss.

Follow the steps below and you can quickly integrate the bull flag into your forex trading. A bull flag is a widely used chart pattern that provides traders with a buy signal indicating the probable resumption of an existing uptrend. Traders use this chart pattern to make good trade decisions.

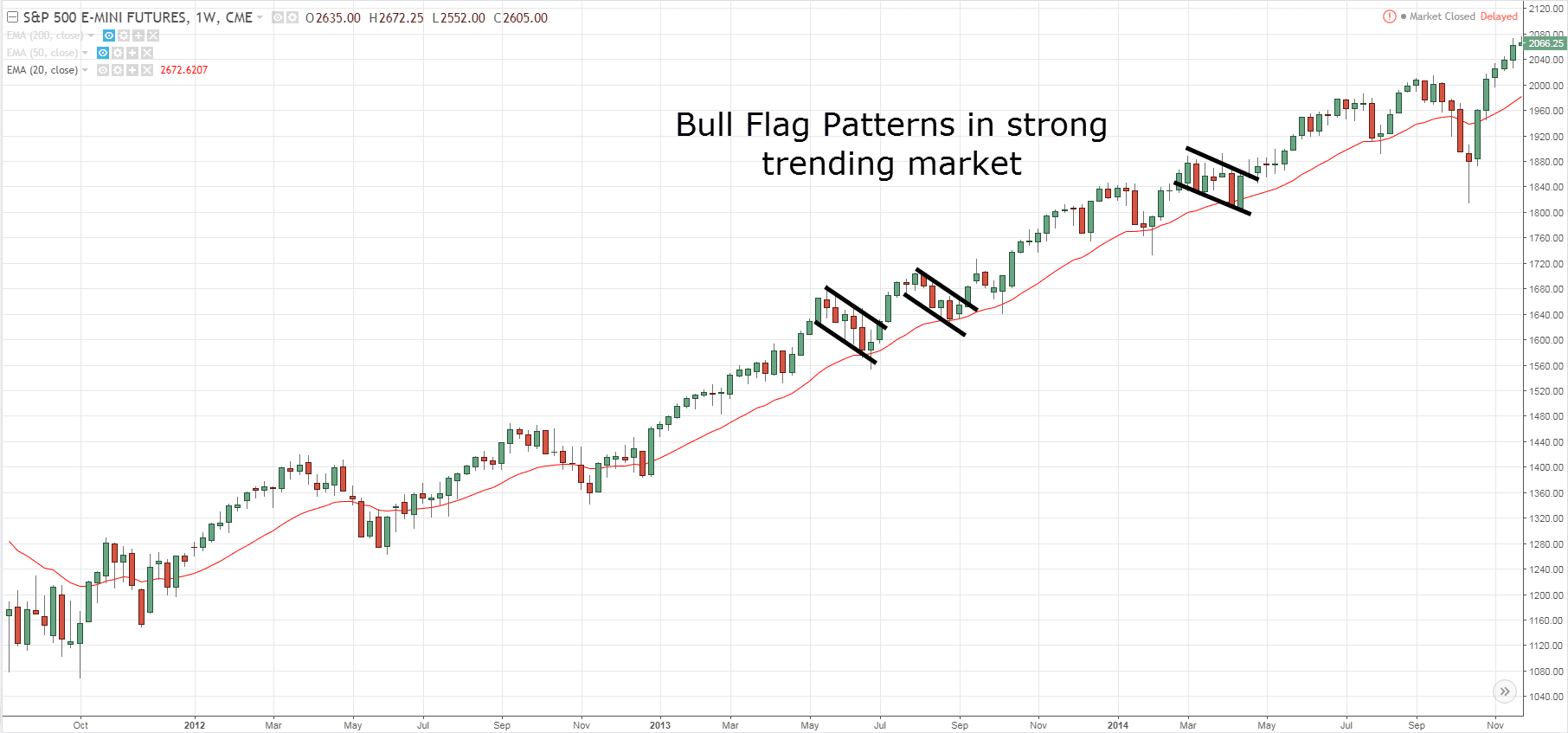

The best times to trade the Bull Flag Pattern is just after the market break out during a strong trending market. How to Trade Bull Flag Chart Patterns. It is defined as a period of consolidation following a sharp rally.

As shown by the bull flag chart pattern above traders have been buying risk. Flag patternbull flag patternflag pattern trading strategyCandlestick Reversal PatternsHow to See Candlestick ChartLive exampleUse of Chart to forecast Tradi. Bull flag and bear flag patterns summed up.

Traded properly it can be among the more reliable. Use a trend line and draw the vertical flag. The following trading example shows the bull flag on a forex chart.

The Bull Flag Pattern is a bullish continuation chart pattern. AUDCAD bull flag pattern. Look for confluence factor-like 20ema.

5 Ways to Connect Wireless Headphones to TV. When the correction begins and the price drops. Its still a bull flag just a different shape.

Surface Studio vs iMac Which Should You Pick. You may say its a bull flag.

How To Trade Bull Flag Pattern Six Simple Steps

How To Trade Bearish And The Bullish Flag Patterns Like A Pro Forex Training Group

Learn How To Trade A Wedge Bull Flag Candlestick Pattern

The Bull Flag Pattern Trading Strategy

The Definitive Guide To Trading The Bull Flag Pattern In Forex

Bull Flag Vs Bear Flag Predict Short Term Trends Phemex Academy

Bullflagpattern Education Tradingview

The Bull Flag Pattern Trading Strategy

Bull Flags And Pennants Definition Chartmill Com

Python Detecting Bull Flag Pattern In Stock Market Data Stack Overflow

Bull Flag Pattern Review How To Trade It Correctly

How To Trade Bull Flag And Bear Flag Pattern Dot Net Tutorials

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Bull Flag Pattern What It Is And Trading Strategies For 2020

How To Yourself Use Bull Flags Bear Flags When Trading Quora

How To Use Bull Flag Entries And Price Targets Youtube