unified estate and gift tax credit 2021

What Is the Unified Tax Credit Amount for 2021. Wednesday January 20 2021 The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million.

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Tax and sewer payments checks only.

. The unified tax credit. A person giving the gifts has a lifetime exemption from. To pay your sewer bill on line click here.

The Internal Revenue Service announced today the official estate and gift tax limits for 2021. If a tax on a gift has been paid under chapter 12 sec. Unified Estate And Gift Tax Credit 2021.

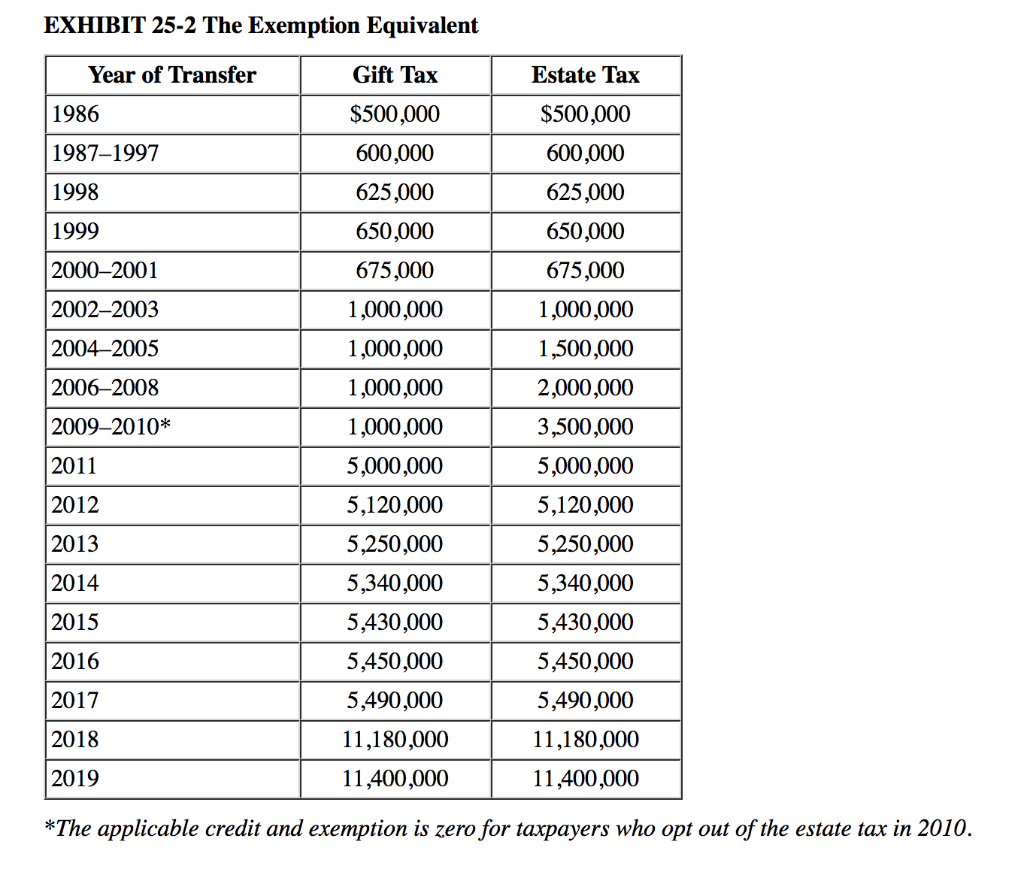

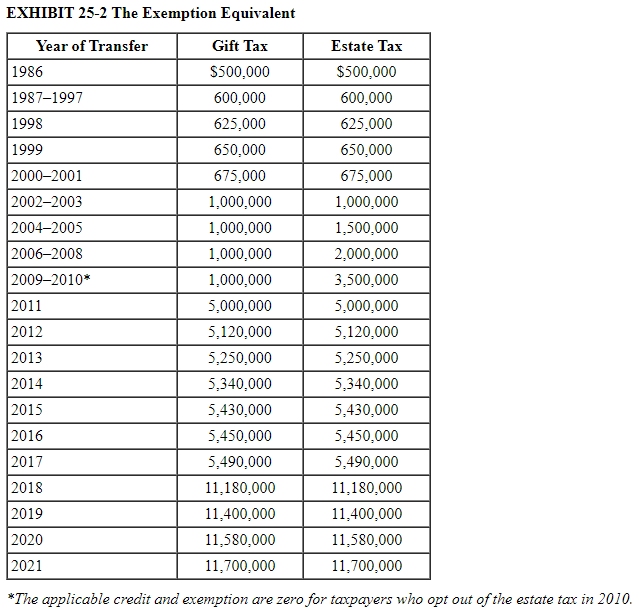

Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. The previous limit for 2020 was 1158 million. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

Unified Estate And Gift Tax Credit 2021. For 2021 the estate and gift tax exemption stands at 117 million per person. Collection of delinquent taxes and municipal.

This means that an individual is currently. This means that you can give 15000 every year to each of. Unified Estate And Gift Tax Credit 2021.

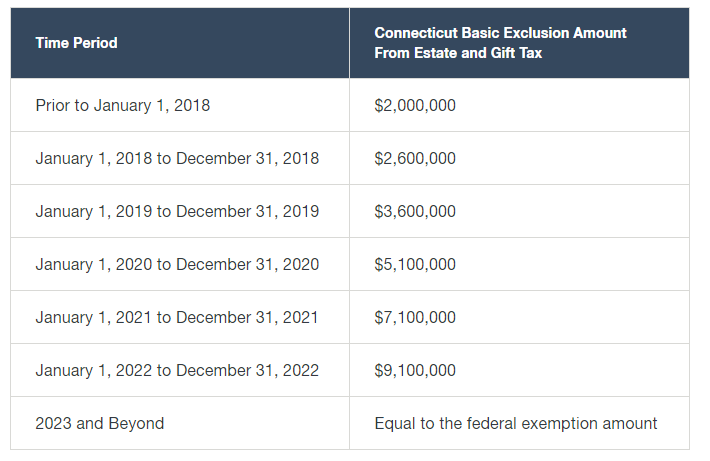

The gift and estate tax. Gift and Estate Tax Exemptions The Unified Credit. However this is set to expire in 2025 at which time.

Tax and Utility Information Look-Up. Tax February 25 2022 arnold. The Tax Collector is responsible for the billing collection reporting and enforcement of municipal property taxes.

The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise. A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system. You are eligible for a property tax deduction or a property tax credit only if.

Beginning in 2022 the annual gift exclusion will be. Estate and Gift Taxes. Any tax due is.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. As of 2021 you are able to give 15000 per year to any individual as a tax-exempt gift. No cash may be dropped off at any time in a box located at the front door of Town Hall.

What is the unified tax credit for 2021. Then there is the exemption for gifts and estate taxes. The estate and gift tax exemption is 117 million per individual up from 1158 million in 2020.

The extent of the benefit. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. It consists of an accounting of everything you own or have certain interests in at.

The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. Division of Taxations Property Tax Relief Program. The estate tax is a tax on your right to transfer property at your death.

2501 and following or under corresponding provisions of prior laws and thereafter on the death of the donor any amount in. Division of Taxations Affordable.

Analyzing Biden S New American Families Plan Tax Proposal

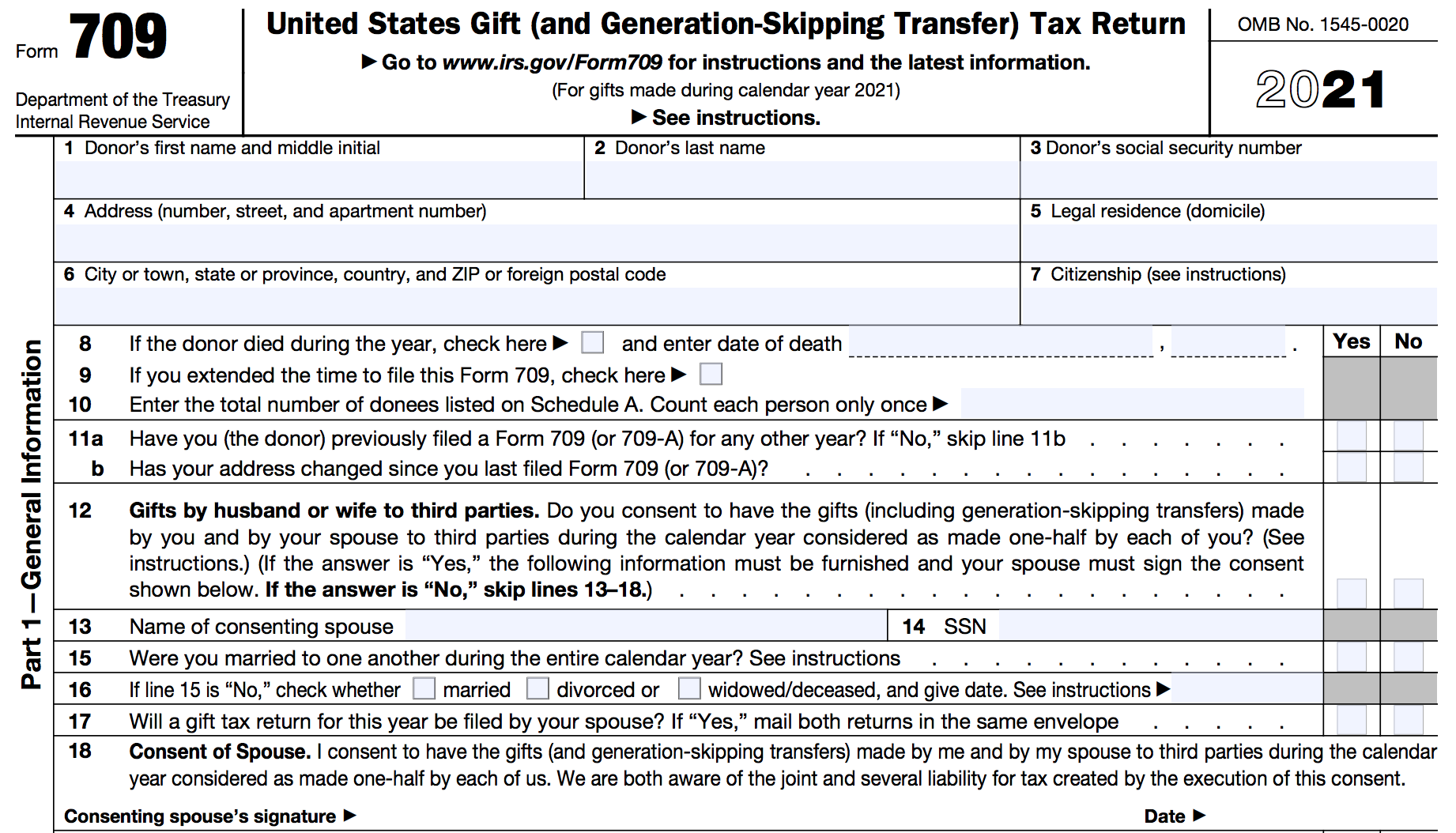

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Gift Tax Archives Sf Tax Counsel

Navigating The Changes To Tax Laws In 2021 University Of Cincinnati

Personal Planning Strategies Lexology

The Estate Tax And Lifetime Gifting Charles Schwab

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

Solved For All Requirements Enter Your Answers In Dollars Chegg Com

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Beware The Generation Skipping Transfer Tax

Generation Skipping Transfer Taxes

Use It Or Lose It Making The Most Of Your Estate Tax Exemption Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Understanding How The Unified Credit Works Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Year End Tax Planning Gift Tax Exclusion Tucson Phoenix Az

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa